PROXY SUMMARY | This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. We encourage you to read the entire Proxy Statement for more information about these topics prior to voting. | | | | OUR LONG-TERM VALUE CREATION STRATEGY |

Our strategy is dependent on continuing to build a culture of growth and innovation to accomplish four major strategic pillars:  |  |  |  | | | | | Re-architect Data Infrastructure Developing the technology underlying the future of Big Data and Fast Data | Lead in the Data Center Focusing on the scale, reliability and capacity necessary for data centers | Seek Targeted Wins at the Edge and End Points Serving the distinctive needs of specific data uses and settings | Continue to Lead in Client Devices & Retail Customer-Focused Solutions Leading in client devices and consumer solutions |

KEY BUSINESS HIGHLIGHTS | | | | POSITIONED FOR GROWTH IN A CHALLENGING MARKET |

Our fiscal 2019 business results were adversely impacted by a cyclical downturn in the flash industry, a temporary pause in investments by datacenter customers and rising uncertainties on the geopolitical front. We delivered fiscal 2019 revenues of $16.6 billion, non-GAAP gross margin of 30.5% and $4.84 in non-GAAP earnings per share (“EPS“).(1)Our business generated $1.5 billion in operating cash flow, and we returned $1.1 billion to shareholders through cash dividends and share repurchases. We also reduced our long-term debt by nearly $750 million. Despite a challenging year, in fiscal 2019, we remained focused on activities that drive long-term value creation for our stockholders. Specifically, we broadened our product portfolio, enhanced our technology positioning and further improved operational efficiency even as we lowered our cost and expense structure. We expect these actions to position us to emerge as a stronger company as the market environment improves. These factors provided important context for the Compensation Committee’s decisions regarding executive pay for the year in review, and as described further in the section entitled “Executive Compensation–Compensation Discussion and Analysis,” fiscal 2019 compensation levels to our executive team reflect the shift in performance results. Strength of Product Portfolio Our ability to continually drive innovation and expand our differentiated product base is an integral element of maintaining leadership in the rapidly evolving data storage industry. To that end, during fiscal 2019, we made significant strides in broadening and enhancing our product offerings, delivering the strongest product portfolio in our company’s history. Achievements of particular note include: | ● | In capacity enterprise hard drives, we demonstrated our leadership through strong adoption of our 14-terabyte high capacity drives across our customer base. | | ● | Combined with our refreshed mid-range capacity air-based drives, we gained significant exabyte share in the capacity enterprise drives category. |

| (1) | See Appendix A to this Proxy Statement for more information about these topics priorreconciliations of GAAP gross margin and GAAP EPS to voting.non-GAAP gross margin and non-GAAP EPS, respectively. |

6 WESTERN DIGITAL

Table of Contents Stockholder Voting MattersPROXY SUMMARY

Annual Meeting of Stockholders

Time●

| We successfully launched our internally developed solid-state drive platforms following multi-year development and Date:

November 4, 2016

8:00 am PTPlace:

3333 Michelson Drive

Irvine, California 92612

Record Date:

September 8, 2016

investment, which deliver significantly higher performance compared to prior offerings. | | ● | We were the first to launch 3D flash-based automotive grade products with unique capacities and capabilities. | | ● | Our retail offerings continued to enjoy excellent recognition across all brands. |

Technology Advances BoardWith approximately 14,000 patents worldwide and Governance Highlightsa broad approach to innovation across our entire technology portfolio, we are continuously developing and investing in new technologies and partnerships to build on our existing technology leadership:

| ● | In flash, we were the first to launch the 96-layer 3D technology that combines industry-leading storage capacity, performance and reliability at a competitive cost. | | ● | In hard drives, we continued to make significant progress towards bringing our energy assisted recording technology to market. This technology is critical to driving continued areal density improvements in next generation capacity enterprise products. | | ● | In May 2019, we announced a formal agreement with our flash joint venture partner Kioxia Corporation (formerly Toshiba Memory Corporation) to jointly invest in a new fab facility. This new facility will provide needed space for the continued transition to future 3D flash technologies. |

Operational Focus Our Board of Director NomineesDirectors and management remain focused on operational efficiency, ensuring that capital is deployed in the most effective way to address existing market conditions and trends, while positioning our company for continued success: | ● | In response to changing business conditions, in January 2019, we announced a program to reduce our annualized cost of revenue and operating expenses by $800 million. These savings should drive significant operating leverage as business conditions continue to improve throughout fiscal 2020. | | ● | During the first quarter of fiscal 2019, we recognized the need to proactively slow down capital deployment and wafer starts to better align with our view of demand for flash. | | ● | We accelerated the streamlining of our hard drive manufacturing footprint and ceased operations at our facility in Kuala Lumpur, Malaysia to focus on higher growth, higher margin segments, such as capacity enterprise. |

Looking Ahead You are being asked to vote on the electionWe successfully managed and navigated dynamic market conditions in fiscal 2019. The secular trends of the nine director nominees listed below, each of whom is currently serving on our Board of Directors. Directors are elected by a majority of votes cast. Detailed information about each director’s background, skillsdata growth and expertise can be found in Proposal 1its increasing value – Election of Directors. The chart below reflects each director’s current committee membership.

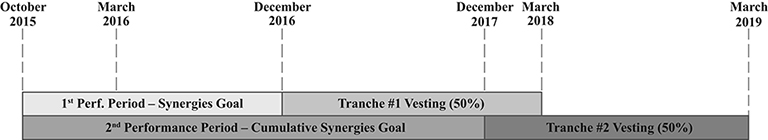

Pursuant to the terms of the merger agreement we entered into in connection with the acquisition of SanDisk Corporation (“SanDisk”), our Board of Directors appointed, effective as of May 12, 2016, Sanjay Mehrotra to serve as a memberkey drivers of our business opportunities – remain strong. Our hard drive business is performing well, and we believe that the flash market has reached a cyclical trough. With the strongest product portfolio in our company’s history and a leaner operating structure, our business is poised to deliver significant operating leverage as business conditions improve further. We believe we are well positioned to deliver long-term growth and stockholder value.

2019 PROXY STATEMENT 7

Table of Contents PROXY SUMMARY OUR DIRECTOR NOMINEES | | Name and Principal Occupation | | Age | Director

Since | Board

Committees | Other Current Public

Directorships |  | | KIMBERLY E. ALEXYINDEPENDENT Principal, Alexy Capital Management | | 49

| 2018

|  | Alteryx, Inc. FireEye, Inc. Five9, Inc. |  | | MARTIN I. COLEINDEPENDENT Former Group Chief Executive, Technology of Accenture plc | | 63 | 2014 |  | The Western Union Company Cloudera, Inc. |  | | KATHLEEN A. COTEINDEPENDENT Former Chief Executive Officer of Worldport Communications, Inc. | | 70 | 2001 |   | VeriSign, Inc. |  | | TUNÇ DOLUCAINDEPENDENT President and Chief Executive Officer of Maxim Integrated | | 61 | 2018 |  | Maxim Integrated |  | | LEN J. LAUER LEAD INDEPENDENT DIRECTOR Chairman and Chief Executive Officer of Memjet | | 62 | 2010 |  | None |  | | MATTHEW E. MASSENGILLINDEPENDENT CHAIRMAN OF THE BOARD Former President and Chief Executive Officer of Western Digital Corporation | | 58 | 2000 |  | None |  | | STEPHEN D. MILLIGAN Chief Executive Officer of Western Digital Corporation | | 56 | 2013 |  | Ross Stores, Inc. Autodesk, Inc. |  | | STEPHANIE A. STREETERINDEPENDENT Former Chief Executive Officer of Libbey Inc. | | 62 | 2018 |  | Goodyear Tire & Rubber Company Kohl’s Corporation |

| | Audit | |  | | Compensation | |  | | Executive | |  | | Governance | |  | | Committee Chair |

| 87.5% Independent | 37.5% Women | 7.8 Years Average Tenure |

| INDEPENDENCE | GENDER |  |  | | | | | | AGE | TENURE |  |  |

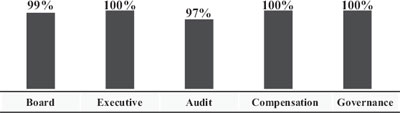

| Strong Director Engagement |

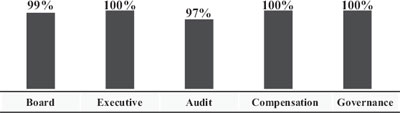

Average director attendance at fiscal 2019 Board and committee meetings | Board | Audit | | 94% | 95% | | Compensation | Governance | | 97% | 100% | | Executive | | | 100% | |

Over 95% Board and committee meeting aggregate attendance in fiscal 2019

8 WESTERN DIGITAL

Table of Directors. Contents PROXY SUMMARY | Director Nominee Skills and Experience |

| |  |  |  |  |  |  |  |  |  | INDUSTRY EXPERIENCE8/8

Experience at the executive level in areas such as data storage, data centers, semiconductors and consumer electronics is important in understanding our business and strategy |  |  |  |  |  |  |  |  |  | RISK MANAGEMENT8/8

Experience in assessing and managing enterprise risks is critical to our Board’s role in overseeing our Enterprise Risk Management program |  |  |  |  |  |  |  |  |  | INFORMATION TECHNOLOGY AND CYBERSECURITY 6/8

Experience understanding and managing information technology and cyber security threats is increasingly important to mitigate risks to our business |  |  |  |  | | |  |  |  | EXECUTIVE-LEVEL LEADERSHIP7/8

Experience in executive-level positions is important to gain a practical understanding of complex organizations, corporate governance, operations, talent development, strategic planning and risk management | |  |  |  |  |  |  |  |  | HUMAN RESOURCES MANAGEMENT7/8

Experience in human resources management in large organizations assists our Board in overseeing succession planning, talent development and our executive compensation program | |  |  |  |  |  |  |  |  | BUSINESS DEVELOPMENT AND STRATEGY8/8

Experience setting and executing long-term corporate strategy is critical as we continue to transform our business |  |  |  |  |  |  |  |  |  | FINANCE AND ACCOUNTING8/8

Experience overseeing accounting and financial reporting is key to our Board’s oversight of our financial reporting process and internal controls |  |  |  |  |  |  |  |  |  | MANUFACTURING AND OPERATIONS6/8

Experience with sophisticated, large-scale manufacturing operations increases our Board’s understanding of our distribution, supply chain, manufacturing and other business operations | | |  |  |  |  |  |  |  | GLOBAL BUSINESS7/8

Experience with businesses with substantial international operations provides critical business and cultural perspectives to our Board and is important in understanding the strategic opportunities and risks relating to our business | |  |  |  |  |  |  |  |  | SALES AND MARKETING7/8

Experience developing and executing on strategies to grow sales and market share assists our Board in advising management as we seek to develop new products and new markets for our products | |  |  |  |  |  |  |  |  | CORPORATE GOVERNANCE8/8

Experience on other public company boards supports strong Board and management accountability, transparency and protection of stockholder interests |  |  |  |  |  |  |  |  |  | GOVERNMENT, LEGAL AND REGULATORY7/8

Experience in government relations, public policy and regulatory matters assists our Board in identifying and understanding compliance issues and the effect of governmental actions on our business | |  |  |  |  |  |  |  |

2019 PROXY STATEMENT 9

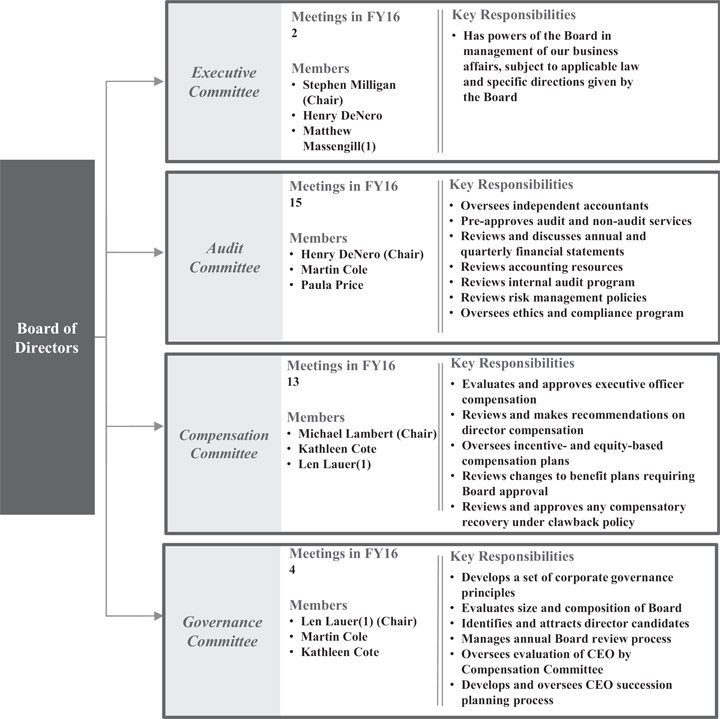

Table of Contents PROXY SUMMARY CORPORATE GOVERNANCE HIGHLIGHTS Our Board of Directors has nominated Mr. Mehrotra for election atis committed to maintaining the Annual Meeting.highest standards of corporate governance. We believe our strong corporate governance practices help promote the long-term interests of our stockholders and build public trust in our company. Name

Current Position | Age | Director

Since | Independent | Executive

Committee | Audit

Committee | Compensation

Committee | Governance

Committee | Martin I. Cole

Former Group Chief Executive, Technology

Accenture plc | 60 | 2014 | Yes | | ¤ | | ¤ | Kathleen A. Cote

Former Chief Executive Officer

Worldport Communications, Inc. | 67 | 2001 | Yes | | | ¤ | ¤ | Henry T. DeNero

Former Chairman and Chief Executive Officer

Homespace, Inc. | 70 | 2000 | Yes | ¤ | Chair | | | Michael D. Lambert

Former Senior Vice President

Dell Inc. | 69 | 2002 | Yes | | | Chair | | Len J. Lauer

Chairman and Chief Executive Officer

Memjet | 59 | 2010 | Yes | | | ¤ | Chair | Matthew E. Massengill

Former President and Chief Executive Officer

Western Digital Corporation | 55 | 2000 | Yes | ¤ | | | | Sanjay Mehrotra

Former President and Chief Executive Officer

SanDisk Corporation | 58 | 2016 | Yes | | | | | Stephen D. Milligan

Chief Executive Officer

Western Digital Corporation | 53 | 2013 | No | Chair | | | | Paula A. Price

Senior Lecturer

Harvard University | 54 | 2014 | Yes | | ¤ | | |

| | i | | | CORPORATE GOVERNANCE CHANGES |

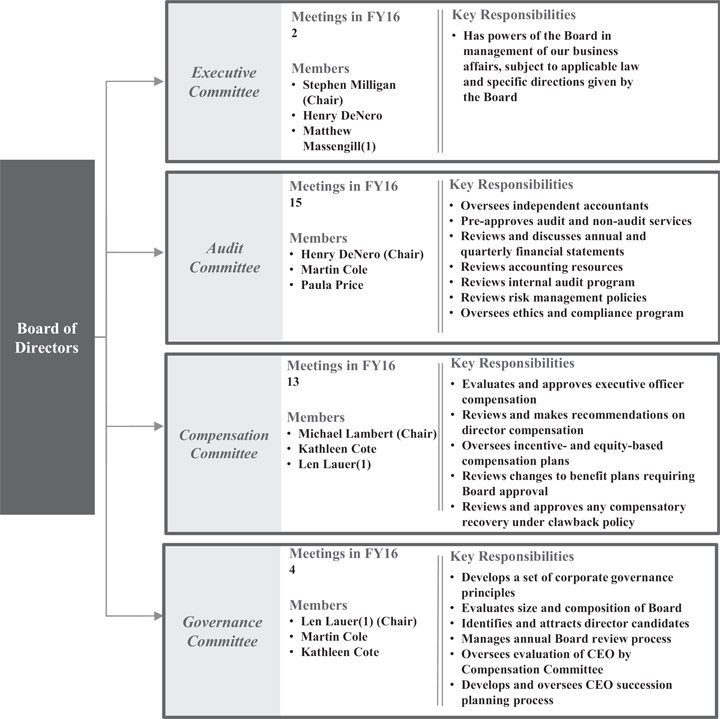

Highly Engaged Directors

(Fiscal 2016 Attendance)

% = Average percentageBelow is a description of meetings attended by directors

some recent key changes to our corporate governance practices: Corporate Governance Information | | | | | | ü | Appointed Three New Independent Directors in Fiscal 2019 |  | Rotated Chair of Audit Committee |  | Formalized Board Oversight of Corporate Responsibility and Sustainability | ●Kimberly Alexy brings to our Board more than 20 years of experience in capital markets, corporate finance and investments, as well as experience serving on numerous public company boards ●Tunç Doluca brings to our Board over 30 years of executive leadership and technical experience in the semiconductor industry ●Stephanie Streeter brings to our Board extensive senior executive leadership experience, as well as experience serving on several public company boards ●The appointments of Ms. Alexy, Mr. Doluca and Ms. Streeter, and the retirements of Henry DeNero and Michael Lambert at the annual meeting under our retirement policy demonstrate our Board’s ongoing commitment to Board refreshment | ●In July 2019, we appointed Ms. Alexy as Chair of the Audit Committee to facilitate the transfer of knowledge from the former Chair of the Audit Committee, Mr. DeNero, to Ms. Alexy, due to Mr. DeNero reaching retirement age under our retirement policy ●Ms. Alexy’s years of experience as a financial analyst, her service on public company boards, including the audit committees of several of these companies, and her certificate in Cybersecurity Oversight from the CERT Division of the Software Engineering Institute at Carnegie Mellon University, enable her to bring valuable experience and a fresh perspective to the Audit Committee ●Mr. DeNero remains on the Audit Committee until his retirement to ensure a smooth transition | ●In August 2019, we amended the Governance Committee’s charter to specify that the Governance Committee will assist our Board in overseeing our corporate responsibility and sustainability policies and programs ●We recently published our 2018 Sustainability Report ●The Governance Committee will provide Board-level input on our social, environmental and human rights policies and programs ●These updates reflect the deep commitment of our Board and executive leadership team to sound corporate responsibility in all aspects of our business |

10 WESTERN DIGITAL

Table of Contents PROXY SUMMARY | | | | CORPORATE GOVERNANCE BEST PRACTICES |

| Robust year-round Board-led stockholder engagement program that informs Board decisions |  | Independent Board leadership, including a Lead Independent Director with clearly defined roles and responsibilities |  | Focus on Board refreshment, with three new directors appointed to our Board in fiscal 2019 |  | Commitment to Board diversity, achieving more than 30% female representation on our Board in fiscal 2019 |  | All directors elected annually by a simple majority of votes cast | ü | Independent BoardSeven of Directors leadership, including lead independenteight director | ü | Eight of nine Board members nominees are independent | ü | Over 90% Board meeting attendance in fiscal 2016 by each director nominated for election at the Annual Meeting | ü | Mandatory directorDirector retirement policy | ü | Commitment toActive Board refreshmentoversight of strategic planning and diversityrisk management | ü | Board riskBoard-level oversight of corporate responsibility and sustainability | ü | Succession planning for directors, chief executive officerour Chief Executive Officer and other key officers | ü | Annual third-party facilitated Board and committee self-evaluations | ü | Individual assessments of directors |  | Code of conduct for directors, officers and employees | ü | All executive officers have achieved stock ownership requirements pursuant to our guidelines |

For additional information, please also see our Governance Overview found at http://www.wdc.com/en/company/governance.FISCAL 2019 EXECUTIVE COMPENSATION HIGHLIGHTS

Key Business Performance Highlights

Fiscal 2016 was a transformative year for our company. We took significant steps to transform into a leading data storage devices and solutions company with global scale and extensive product and technology assets. The significance of the transformative events in fiscal 2016 increased the scale and scope of the operations led by our named executive officers. These events provided an important context for our Compensation Committee’s decisions regarding executive pay, including our ability to retain, incentivize and reward our named executive officers during this critical time.

| ü | SanDisk Acquisition: In May 2016, we completed the acquisition of SanDisk, a global leader in flash storage solutions, creating a leader in storage technology with a robust portfolio of products and solutions. |

| ü | Subsidiary Integration: In October 2015, we received a decision from China’s Ministry of Commerce (“MOFCOM”) enabling us to integrate substantial portions of our HGST and WD subsidiaries following a “hold separate” restriction associated with our acquisition of HGST in March 2012. |

| ü | Joint Venture: In November 2015, we announced an agreement to form a joint venture with our strategic partner, Unisplendour Corporation Limited (“Unis”), to market and sell our current data center storage systems in China and to develop data center storage solutions for the Chinese market. |

We also achieved solid financial performance in fiscal 2016, amidst the opportunities and challenges presented by these transformative events and a rapidly changing PC market.

| ü | Revenue: Fiscal 2016 revenue was $13 billion. |

| ü | Net Income: Fiscal 2016 net income was $242 million, or $1.00 per share. |

| ü | Cash Flow: We generated $2 billion in cash from operations and returned an aggregate of $524 million to stockholders in the form of dividends and stock repurchases. |

| | ii | | | FISCAL 2019 PAY ALIGNED WITH PERFORMANCE |

Compensation

Pay Aligned with Performance

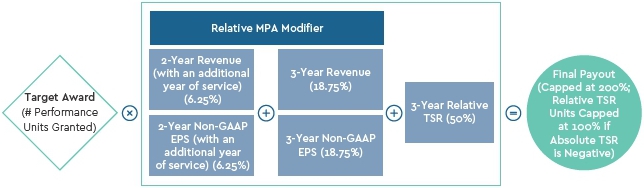

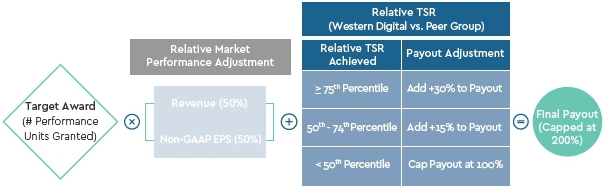

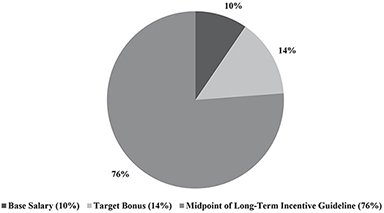

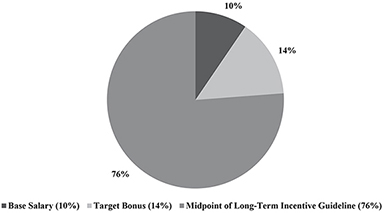

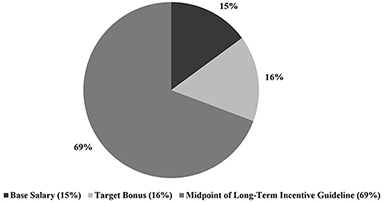

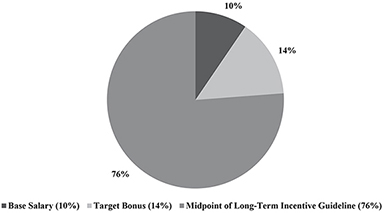

Our overriding executive compensation philosophy is clear and consistent—we pay for performance. Our executives are accountable for the performance of theour company and the operations they manage and are compensated primarily based on that performance. Approximately 90% Chief Executive Officer Compensation Aligned with Performance Results We experienced challenging market and geopolitical conditions in fiscal 2019 and the total compensation for our executive team declined in fiscal 2019 relative to fiscal 2018, reflecting the alignment between our executive compensation program and our lower operational and financial results compared to fiscal 2018. Based on compensation paid or awarded, the compensation of our Chief Executive Officer, Stephen D. Milligan,decreased 24.9% from fiscal 2018 to fiscal 2019: | Chief Executive Officer Pay Year-over-Year | | Pay Element | Fiscal 2018 | Fiscal 2019 | Year-over-Year Change | | Base Salary | $1,250,000 | $1,250,000 | 0% | Short-Term Incentive (“STI”) Award

(based on amount earned) | $2,175,000 | $0 | (100%) | Long-Term Incentive (“LTI”) Award(1)

(based on grant date fair value) | $13,417,083 | $11,601,177 | (13.5%) | | All Other Compensation | $279,391 | $15,292 | (94.5%) | | Total Chief Executive Officer Pay (Fiscal 2018 vs. Fiscal 2019) | $17,121,474 | $12,866,469 | (24.9%) |

| | | (1) | The fiscal 2018 LTI award value excludes a $2.6 million adjustment for a prior year (fiscal 2016-2017) performance stock unit (“PSU”) award that paid out in fiscal 2018 and was required to be reported in the Summary Compensation Table as compensation for fiscal 2018 in accordance with SEC and accounting rules. Our Chief Executive Officer’s total compensation as reported in the Summary Compensation Table for fiscal 2018 was $19,738,381; excluding the $2.6 million accounting adjustment results in total compensation of $17,121,474. |

2019 PROXY STATEMENT 11

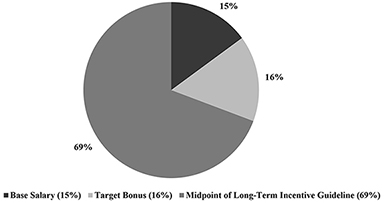

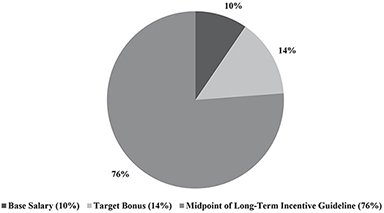

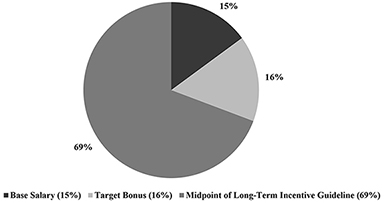

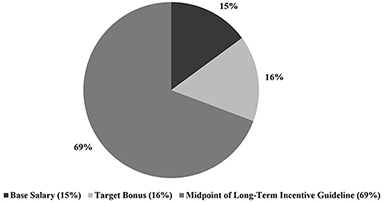

Table of Contents PROXY SUMMARY Pay for Performance Design The charts below illustrate the mix of fiscal 2019 fixed pay (base salary) and variable or performance-based pay (annual STI target total direct compensationand annual LTI awards based on the target award value approved by the Compensation Committee) for fiscal 2016,our Chief Executive Officer and approximately 85% (on average) of our other named executive officers’ target total direct compensation for fiscal 2016, was “at risk” and variable compensation based on our stock price performance and achievement of other specified financial and strategic performance goals. officers (on average). | Chief Executive Officer Pay Mix | | Named Executive Officer Average Pay Mix | |  | Pay Mix (other than Chief Executive

Officer)(1) | |

| | | (1) | Excludes Robert K. Eulau, who was appointed Chief Financial Officer in May 2019 and was not subject to the same compensation arrangements as individuals who served as named executive officers for the full fiscal year. |

| |  | | STOCKHOLDER ENGAGEMENT IN FISCAL 2019 |

Our Board of Directors and management are committed to regular engagement with our stockholders and soliciting their views and input on important performance, executive compensation, governance, environmental, social human capital management and other matters. As a continuation of our robust outreach program, over the past year, we reached out to stockholders representing approximately 46% of shares outstanding. Our engagement team conducted calls with investors representing approximately 12% of shares outstanding, with the remainder either not responding or confirming that a follow-up discussion was not necessary at this time. While our discussions with investors covered a variety of topics, there were a few key areas of focus in our conversations: | ● | Board composition and refreshment efforts, including the recent additions to our Board; | | ● | Executive compensation philosophy and program design, including how investor feedback drove recent program enhancements; and | | ● | Diversity and culture at Western Digital, including recent developments and enhanced disclosure in our 2018 Sustainability Report. |

These views were shared with our Board and its committees, where applicable, for their consideration. 12 WESTERN DIGITAL

Table of Contents PROXY SUMMARY | | | | OUR COMMITMENT TO CORPORATE SUSTAINABILITY |

We believe responsible and sustainable business practices support our long-term success as a company. Certainly, those practices help keep our communities and our environment vibrant and healthy. But they also lead us to more efficient and resilient business operations. They help us meet our customers’ efficiency targets. They reduce risks of misconduct and legal liability. They enhance the reliability of our supply chain. And they improve the health, well-being, engagement and productivity of our employees. We believe that being an industry leader is not just about having talented employees or innovative products. It is also about doing business the right way, every day. That is why our commitment to sound corporate responsibility is deeply rooted in all aspects of our business. We are happy to share more details about our recent progress in this area through our 2018 Sustainability Report located on our Corporate Sustainability page at www.westerndigital.com (which is not incorporated by reference herein). The Governance Committee oversees our corporate responsibility and sustainability policies and programs pursuant to its charter. Below are some highlights from our 2018 Sustainability Report:

|  |  | | | | Architecting

Sustainable Products | Architecting a Responsible

Supply Chain | Architecting Vibrant Communities | We take responsibility for how our products impact the environment and communities. We believe transparency enhances accountability, helping us improve the long-term sustainability of our products and business. __________

Efficient packaging conserved 650,000 kg of paper during calendar 2018 __________

Technology innovations reduced power consumption on a per-gigabyte basis by 970 million kilowatt-hour | The need for greater transparency is driving behavioral change in corporate supply chains, as global interconnectedness is greater than ever. We embrace and facilitate this change with our forward-thinking responsible supply chain program, based on a commitment to collaborate with suppliers and key stakeholders to ensure that our value chain is socially responsible and sustainable over the long run. __________

Achieved one Platinum, two Gold and two Silver certificates after Responsible Business Alliance factory audits __________

Audited all of our suppliers of conflict minerals, achieving fully compliant sourcing by the end of calendar 2018 | We believe that corporate sustainability should go beyond environmental and labor considerations to provide a positive social impact on the local communities in which we operate. This has led us to an impactful giving and volunteerism program around the world, a deep commitment to inspiring and providing opportunities for future talent through STEM education and scholarship programs and utilizing our technology and expertise to create positive change on a macro scale. __________

In calendar 2018, employees from 18 different sites volunteered 5,000 hours for Earth Day __________

Employees packaged more than two million meals for people without adequate food | | | |  |  |  | | | | | Architecting an Ethical Business | Architecting a Better Environment | Architecting a Stronger Workforce | ComponentsWorking with integrity is a part of our culture—one that we work hard to maintain and enhance. Our efforts help earn the trust of our customers and business partners, inspire our employees, deliver value for our stockholders and improve our communities.

__________

Recognized as one of the World’s Most Ethical Companies in February 2019 __________

Conducted global code of conduct training with nearly 30,000 employees in 39 countries over the past year | As we look to the future, Western Digital recognizes that environmental stewardship is critical to the long-term success of our company, our customers and other stakeholders. We are fully committed to responsible use of the Earth’s natural resources and we strive to minimize any impact on climate change as we work together to architect a better future. __________

Achieved a 3% reduction in overall energy consumption in calendar 2018 __________

Reduced our scope 1 greenhouse gas emissions by 17% between calendar 2016 and 2018 | Our people are our most important asset. Calendar 2018 was a milestone year for our workforce: we focused on creating a unified culture, amplifying the best aspects of our three legacy companies and architecting our path forward as one Western Digital. __________

Received a perfect score for diversity and inclusion for LGBTQ employees from Human Rights Campaign __________

Sponsor employee resource groups, including for diverse employees, female employees, LGBTQ employees and veterans |

2019 PROXY STATEMENT 13

Table of Contents Corporate Governance Matters | PROPOSAL 1 | ELECTION OF DIRECTORS | | |

| Our Board of Directors recommends a voteFOR each of the eight director nominees named in this Proxy Statement. |

| ● | All directors elected annually by a simple majority of votes cast | | ● | Independent Board leadership, including a Lead Independent Director with clearly defined roles and responsibilities | | ● | Seven of eight director nominees are independent |

Our Board of Directors is presenting eight nominees for election as directors at the 2019 annual meeting of stockholders (“Annual Meeting”). Each of the nominees is currently a member of our Board and, other than Ms. Alexy and Ms. Streeter, who joined our Board in November 2018, was elected to our Board at the 2018 annual meeting of stockholders. Each director elected at the Annual Meeting will serve until our 2020 annual meeting of stockholders and until a successor is duly elected and qualified. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director if elected. If any nominee is unable or unwilling for good cause to stand for election or serve as a director if elected, the persons named as proxies may vote for a substitute nominee designated by our existing Board of Directors, or our Board may choose to reduce its size. | | | | VOTE REQUIRED FOR APPROVAL |

Each director nominee will be elected as a director if the nominee receives the affirmative vote of a majority of the votes cast with respect to his or her election (in other words, the number of shares voted “for” a director must exceed the number of votes cast “against” that director). If a nominee who is serving as a director is not elected at the Annual Meeting by the requisite majority of votes cast, Delaware law provides that the director would continue to serve on our Board of Directors as a “holdover director.” However, under our By-laws, any incumbent director who fails to be elected must offer to tender his or her resignation to our Board. If the director conditions his or her resignation on acceptance by our Board, the Governance Committee will then make a recommendation to our Board on whether to accept or reject the resignation or whether other action should be taken. Our Board of Directors will act on the Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who tenders his or her resignation will not participate in our Board’s or the Governance Committee’s decision. Any nominee who was not already serving as a director and is not elected at the Annual Meeting by a majority of the votes cast with respect to such director’s election would not be elected to our Board. 14 WESTERN DIGITAL

Table of Contents CORPORATE GOVERNANCE MATTERS NOMINEES FOR ELECTION Below is information about the experience and other key qualifications and attributes of each of our Board’s eight director nominees. KIMBERLY E. ALEXY | INDEPENDENT |

| AGE | 49 | DIRECTORSINCE | November 2018 | COMMITTEES | Audit (Chair) | |

PROFESSIONAL EXPERIENCE | | ● | Ms. Alexy is a seasoned financial services professional with more than 20 years of experience in capital markets, corporate finance and investments. She founded Alexy Capital Management, a private investment fund, in 2005 and serves as its principal. | | ● | Previously, Ms. Alexy served as a sell-side equity research analyst on Wall Street for nearly a decade, specializing in the technology and corporate finance industries at Prudential Securities, Lehman Brothers and Wachovia Bank. | | ● | Within the last five years, Ms. Alexy served as a director of Microsemi Corporation and CalAmp Corp. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | Alteryx, Inc. | | ● | FireEye, Inc. | | ● | Five9, Inc. |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Ms. Alexy’s deep expertise in finance, securities and corporate governance at several financial institutions and publicly held companies is directly relevant to our business. Her service on numerous public company boards of directors, including serving as a chair on the audit or governance committees of many of those boards, provides our Board with valuable insights and perspectives. We believe these experiences, qualifications, attributes and skills qualify her to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Audit Committee Chair | | ● | Ms. Alexy’s financial skills and prior experience as a financial analyst for nearly a decade and her service as a member of several public company audit committees qualify her as an audit committee financial expert under SEC rules. In addition, Ms. Alexy contributes her specialized knowledge of cybersecurity issues, which includes a CERT Certificate in Cybersecurity Oversight for corporate directors issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University. |

MARTIN I. COLE | INDEPENDENT |

| AGE | 63 | DIRECTORSINCE | December 2014 | COMMITTEES | Audit | Governance |

PROFESSIONAL EXPERIENCE | | ● | Mr. Cole served as the chief executive of the technology group of Accenture plc, a leading global management consulting and professional services company, with responsibility for the full range of Accenture’s technology consulting and outsourcing solutions and delivery capabilities, including its global delivery network, from March 2012 until he retired in August 2014. Mr. Cole currently serves as a senior adviser to 3i Group plc. | | ● | Previously, Mr. Cole served as the chief executive of Accenture’s communications, media and technology operating group from September 2006 to March 2012, the chief executive of its government operating group from September 2004 to August 2006, the managing partner of its outsourcing and infrastructure delivery group from September 2002 to August 2004 and in a variety of capacities at Accenture since 1980. | | ● | On July 31, 2019, Mr. Cole was appointed interim chief executive officer of Cloudera, Inc., an enterprise data cloud company, to help ensure a smooth executive transition while its board of directors conducts a search for a permanent chief executive officer. The appointment is expected to be temporary. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | The Western Union Company | | ● | Cloudera, Inc. |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Mr. Cole brings to our Board extensive senior executive leadership experience across a variety of business sectors and geographies. This demonstrates his ability to provide strategic advice and lead multiple teams across a variety of business sectors, and provides him with wide-ranging insights, including relating to technology solutions, which are an important part of our business. We believe these experiences, qualifications, attributes and skills qualify him to serve as a member of our Board of Directors. Our Board of Directors has discussed with Mr. Cole the time and effort required of him as Cloudera’s interim chief executive officer in conjunction with his role as a member of our Board, and has affirmatively determined that his interim position at Cloudera does not impair his ability to continue serving as an effective member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Audit Committee Member | | ● | Mr. Cole’s financial skills and prior experience as a chief executive qualify him as an audit committee financial expert under SEC rules. | Governance Committee Member | | ● | Mr. Cole has substantial governance experience as chairman of the board of Cloudera, Inc. and as a director of The Western Union Company. |

2019 PROXY STATEMENT 15

Table of Contents CORPORATE GOVERNANCE MATTERS KATHLEEN A. COTE | INDEPENDENT |

| AGE | 70 | DIRECTOR SINCE | January 2001 | COMMITTEES | Compensation Structure

Governance | |

Base SalaryPROFESSIONAL EXPERIENCE

| | ● | DesignedMs. Cote was the chief executive officer of Worldport Communications, Inc., a European provider of Internet managed services, from May 2001 to be competitiveJune 2003. | | ● | Prior to that, Ms. Cote served as president of Seagrass Partners, a provider of expertise in business planning and strategic development for early stage companies, from September 1998 to May 2001. From November 1996 to January 1998, she served as president and chief executive officer of Computervision Corporation, an international supplier of product development and data management software. | | ● | Within the last five years, Ms. Cote served as a director of GT Advanced Technologies, Inc. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | VeriSign, Inc. |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Ms. Cote is a seasoned business executive with marketnumerous years of experience overseeing global companies focused on technology and operations, which is directly relevant to our business. She has served on numerous public company boards of directors, including on the audit and governance committees of those boards, providing our Board with valuable board-level experience. Her tenure on our Board also provides us with specific expertise and insight into our business and the transformations it has undergone. We believe these experiences, qualifications, attributes and skills qualify her to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Compensation Committee Member | | ● | Ms. Cote has significant experience establishing and overseeing executive compensation programs as a former chief executive officer and as a public company board member. | Governance Committee Member | | ● | Ms. Cote has substantial governance experience as a director of VeriSign, Inc. and as a former director of a number of public companies. |

| AGE | 61 | DIRECTOR SINCE | August 2018 | COMMITTEES | | Compensation | |

PROFESSIONAL EXPERIENCE | | ● | Mr. Doluca is the president and chief executive officer of Maxim Integrated, which designs, develops, manufactures and markets a broad range of linear and mixed-signal integrated circuits. | | ● | Prior to being named Maxim Integrated’s president and chief executive officer in January 2007, Mr. Doluca served as its group president from May 2005 to January 2007, senior vice president from 2004 to 2005 and vice president from 1994 to 2004. Prior to 1994, Mr. Doluca served in a number of integrated circuit development positions at Maxim Integrated since joining the company in 1984. | | ● | Mr. Doluca is a board member of the Semiconductor Industry Association and served as its chairman from 2017 to 2018. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | Maxim Integrated |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Mr. Doluca brings to our Board over 30 years of executive leadership and technical experience in the semiconductor industry, normswhich provides our Board with valuable perspectives directly relevant to our business. As a seasoned chief executive officer and director of a large public technology company, he has expertise in corporate strategy, financial management, operations, marketing and research and development, which are all critical to reflect individual performanceachieving our strategic objectives. We believe these experiences, qualifications, attributes and skills qualify him to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Compensation Committee Member | | ● | Mr. Doluca has significant experience establishing and overseeing executive compensation programs as the chief executive officer of Maxim Integrated. |

16 WESTERN DIGITAL

Table of Contents CORPORATE GOVERNANCE MATTERS LEN J. LAUER | LEAD INDEPENDENT DIRECTOR |

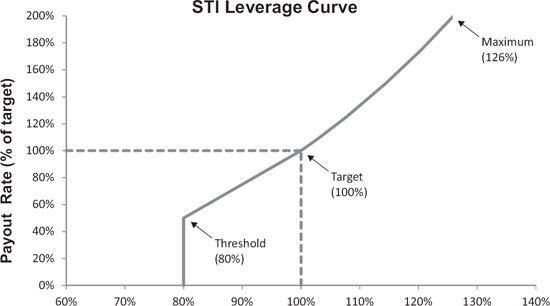

| AGE | 62 | DIRECTOR SINCE | August 2010 | COMMITTEES | Short-Term Incentive Compensation (Chair)

Governance (Chair) | Performance-based cash bonus opportunity, generally based |

PROFESSIONAL EXPERIENCE | | ● | Mr. Lauer is the chairman and chief executive officer of Memjet, a color printing technology company. | | ● | Prior to joining Memjet in January 2010, Mr. Lauer was executive vice president and chief operating officer of Qualcomm, Inc., a developer and manufacturer of digital telecommunications products and services, from August 2008 to December 2009, and he was executive vice president and group president from December 2006 to July 2008. From August 2005 to August 2006, he was chief operating officer of Sprint Nextel Corp., a global communications company, and he was president and chief operating officer of Sprint Corp. from September 2003 until the Sprint-Nextel merger in August 2005. Prior to that, he was president-Sprint PCS from October 2002 to October 2004, and was president-long distance (formerly the global markets group) from September 2000 to October 2002. Mr. Lauer also served in several executive positions at Bell Atlantic Corp. from 1992 to 1998 and spent the first 13 years of his business career at IBM in various sales and marketing positions. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | None |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Mr. Lauer brings to our Board significant senior executive leadership experience from large, multinational public technology companies, which provides a valuable perspective to our Board. Mr. Lauer’s experience in semiconductor sourcing and integration at Qualcomm and Memjet provides our Board with perspectives on adjusted earnings per sharethe semiconductor industry. He has also previously served on other public company boards and board committees, providing our Board with important board-level experience. We believe these experiences, qualifications, attributes and skills qualify him to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Governance Committee Chair | | ● | Mr. Lauer has served on other public company boards and board committees and has significant experience leading public and private companies in both board and senior executive leadership roles. | Compensation Committee Chair | | ● | Mr. Lauer has significant senior executive leadership experience from large, multi-national public technology companies, with substantial experience establishing and overseeing executive compensation programs. |

MATTHEW E. MASSENGILL | INDEPENDENT CHAIRMAN OF THE BOARD |

| AGE | 58 | DIRECTOR SINCE | January 2000 | COMMITTEES | | Executive | |

PROFESSIONAL EXPERIENCE | | ● | Mr. Massengill served as our President from January 2000 to January 2002 and our Chief Executive Officer from January 2000 to October 2005. Mr. Massengill previously also served as our Chairman of the Board from November 2001 to March 2007. | | ● | Prior to that, Mr. Massengill served as our Chief Operating Officer from October 1999 to January 2000 and in various executive capacities since joining our company in 1985. | | ● | Within the last five years, Mr. Massengill served as a director of GT Advanced Technologies, Inc. and Microsemi Corporation. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | None |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Mr. Massengill’s many years of service to Western Digital as an executive and Board member provide our Board with extensive and significant experience directly relevant to our business. As our former Chief Executive Officer, he has a deep understanding of our operations, provides valuable knowledge to our Board on the issues we face to achieve our strategic objectives and has extensive international experience. His prior service on numerous other public company boards of directors also provides our Board with important board-level perspective. We believe these experiences, qualifications, attributes and skills qualify him to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Executive Committee Member | | ● | Mr. Massengill has extensive and significant experience as an executive, including as a former Chief Executive Officer, Chief Operating Officer and Board member of our company. |

2019 PROXY STATEMENT 17

Table of Contents CORPORATE GOVERNANCE MATTERS STEPHEN D. MILLIGAN | CHIEF EXECUTIVE OFFICER |

| AGE | 56 | DIRECTOR SINCE | January 2013 | COMMITTEES | | Executive (Chair) | |

PROFESSIONAL EXPERIENCE | | ● | Mr. Milligan has served as our Chief Executive Officer since January 2013 and served as our President from March 2012 to October 2015. | | ● | Prior to that, Mr. Milligan served as HGST’s president and chief executive officer from December 2009 until our acquisition of HGST in March 2012 and its president from March 2009 to December 2009. From September 2007 to October 2009, Mr. Milligan served as HGST’s chief financial officer. From January 2004 to September 2007, he served as our Chief Financial Officer after serving in other senior finance roles at our company from September 2002 to January 2004. From April 1997 to September 2002, he held various financial and accounting roles of increasing responsibility at Dell Inc. and was employed at Price Waterhouse for 12 years prior to joining Dell. | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS | | ● | Ross Stores, Inc. | | ● | Autodesk, Inc. |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Mr. Milligan’s experience in our industry, including more than four years in senior management positions at HGST as its president and chief executive officer, in addition to other senior management roles, contributes indispensable knowledge and expertise to our Board. He has served Western Digital and HGST in numerous executive capacities, providing our Board with valuable operations, manufacturing and finance experience. We believe these experiences, qualifications, attributes and skills qualify him to serve as a semi-annual performance periodmember of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Executive Committee Chair | | ● | Mr. Milligan serves as our Chief Executive Officer and has held numerous senior executive roles at our company and other large, multi-national technology companies, including HGST. |

STEPHANIE A. STREETER | INDEPENDENT |

| AGE | 62 | DIRECTOR SINCE | November 2018 | COMMITTEES | Long-Term Incentive CompensationAudit

Governance | • |

PROFESSIONAL EXPERIENCE | | ● | Ms. Streeter served as the chief executive officer of Libbey Inc., a producer of glass tableware and other tabletop products, from 2011 to 2016, where she developed and implemented a new corporate strategy and reconstructed the company’s balance sheet, manufacturing network and cost base. | | ● | Prior to that, Ms. Streeter served as the acting chief executive officer of the United States Olympic Committee from 2009 to 2010 and served on its board of directors from 2004 to 2009. Previously, Ms. Streeter held numerous senior management positions at Banta Corporation, a global technology, printing and supply-chain management company, where she served as chairman, president and chief executive officer, and at Avery Dennison Corporation, a global materials science and manufacturing company. | | ● | Within the last five years, Ms. Streeter served as a director of Olin Corporation. | Performance Stock Units (“PSUs”) –OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

| | ● | Goodyear Tire & Rubber Company | | ● | Kohl’s Corporation |

BOARD SKILLS, QUALIFICATIONS AND EXPERTISE | Ms. Streeter brings to our Board extensive senior executive leadership experience overseeing companies with manufacturing and operations across the globe. She has served on several public company boards of directors. We believe these experiences, qualifications, attributes and skills qualify her to serve as a member of our Board of Directors. | COMMITTEE EXPERTISE HIGHLIGHTS | Audit Committee Member | | ● | Ms. Streeter’s financial skills and years of experience as a chief executive officer and public company audit committee chair qualify her as an audit committee financial expert under SEC rules. | Governance Committee Member | | ● | Ms. Streeter has substantial governance experience as a director of Goodyear Tire & Rubber Company and Kohl’s Corporation, and as a former director of several public companies. |

18 WESTERN DIGITAL

Table of Contents CORPORATE GOVERNANCE MATTERS | | | | DIRECTOR SKILLS AND EXPERTISE |

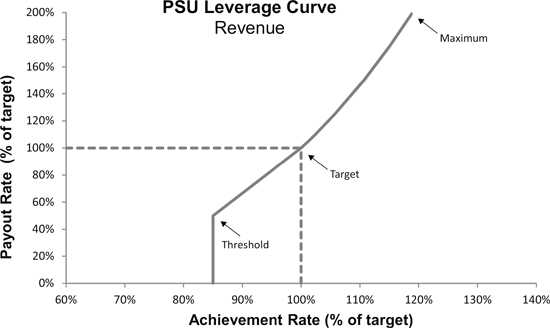

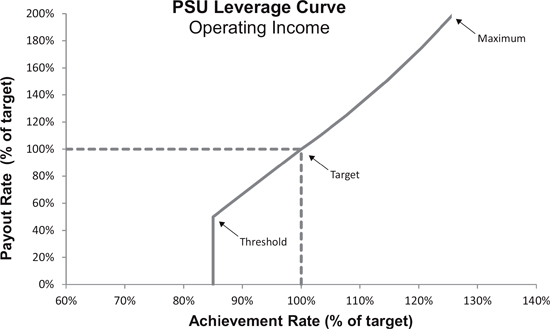

Our Board of Directors believes our nominees’ breadth of experience and their mix of qualifications, attributes, tenure and skills strengthen our Board’s independent leadership and effective oversight of management. | 87.5% Independent | 37.5% Women | 7.8 Years Average Tenure | | | | | | INDEPENDENCE | GENDER | •AGE | Annual PSUs generally basedTENURE |  |  |  |  |

| Director Nominee Skills and Experience |

| |  |  |  |  |  |  |  |  |  | INDUSTRY EXPERIENCE8/8

Experience at the executive level in areas such as data storage, data centers, semiconductors and consumer electronics is important in understanding our business and strategy |  |  |  |  |  |  |  |  |  | RISK MANAGEMENT8/8

Experience in assessing and managing enterprise risks is critical to our Board’s role in overseeing our Enterprise Risk Management program |  |  |  |  |  |  |  |  |  | INFORMATION TECHNOLOGY AND CYBERSECURITY6/8

Experience understanding and managing information technology and cybersecurity threats is increasingly important to mitigate risks to our business |  |  |  |  | | |  |  |  | EXECUTIVE-LEVEL LEADERSHIP7/8

Experience in executive-level positions is important to gain a practical understanding of complex organizations, corporate governance, operations, talent development, strategic planning and risk management | |  |  |  |  |  |  |  |  | HUMAN RESOURCES MANAGEMENT7/8

Experience in human resources management in large organizations assists our Board in overseeing succession planning, talent development and our executive compensation program | |  |  |  |  |  |  |  |  | BUSINESS DEVELOPMENT AND STRATEGY8/8

Experience setting and executing long-term corporate strategy is critical as we continue to transform our business |  |  |  |  |  |  |  |  |  | FINANCE AND ACCOUNTING8/8

Experience overseeing accounting and financial reporting is key to our Board’s oversight of our financial reporting process and internal controls |  |  |  |  |  |  |  |  |  | MANUFACTURING AND OPERATIONS6/8

Experience with sophisticated, large-scale manufacturing operations increases our Board’s understanding of our distribution, supply chain, manufacturing and other business operations | | |  |  |  |  |  |  |  | GLOBAL BUSINESS7/8

Experience with businesses with substantial international operations provides critical business and cultural perspectives to our Board and is important in understanding the strategic opportunities and risks relating to our business | |  |  |  |  |  |  |  |  | SALES AND MARKETING7/8

Experience developing and executing on operating incomestrategies to grow sales and revenue, with a relative totalmarket share assists our Board in advising management as we seek to develop new products and new markets for our products | |  |  |  |  |  |  |  |  | CORPORATE GOVERNANCE8/8

Experience on other public company boards supports strong Board and management accountability, transparency and protection of stockholder return (“TSR”) hurdle capping payout at target level if relative TSR is belowinterests |  |  |  |  |  |  |  |  |  | GOVERNMENT, LEGAL AND REGULATORY7/8

Experience in government relations, public policy and regulatory matters assists our Board in identifying and understanding compliance issues and the median, and subject to automatic adjustment in the same proportion by which the total available market (“TAM”) for hard drives exceeds or falls shorteffect of the TAM forecasted by the Boardgovernmental actions on our business | |  |  |  |  |  |  |  |

| | | | | | | | • | | | Other PSUs generally tiedOur Board is highly engaged and well qualified, and all director nominees possess the skills and experiences necessary to pre-established company financial,oversee our evolving and growing business. | |

2019 PROXY STATEMENT 19

Table of Contents CORPORATE GOVERNANCE MATTERS | | | | DIRECTOR MEETING ATTENDANCE |

During fiscal 2019, our Board of Directors met seven times. Each of the directors who served during fiscal 2019 attended 75% or more of the aggregate number of Board meetings and meetings of our Board committees on which he or she served during fiscal 2019. Our Board of Directors strongly encourages each director to attend our annual meeting of stockholders. All of our directors standing for election at the 2018 annual meeting of stockholders were in attendance. | Strong Director Engagement |

Average director attendance at fiscal 2019 Board and committee meetings | Board | | Audit | | 94% | | 95% | | Compensation | | Governance | | 97% | | 100% | | Executive | | | | 100% | | |

Over 95% Board and committee meeting aggregate attendance in fiscal 2019 Our Board of Directors has reviewed and discussed information provided by the directors and our company with regard to each director’s business and personal activities, as well as those of the director’s immediate family members, as they may relate to our company or our management. The purpose of this review is to determine whether there are any transactions or relationships that would be inconsistent with a determination that a director is independent under the listing standards of the Nasdaq Stock Market. Based on its review, our Board has affirmatively determined that, except for serving as a member of our Board of Directors, none of the non-employee director nominees for the Annual Meeting (Messrs. Cole, Doluca, Lauer or Massengill, or Mses. Alexy, Cote or Streeter) or the other current members of our Board who are not standing for re-election at the Annual Meeting due to reaching the retirement age under our retirement policy (Mr. DeNero and Mr. Lambert) has any relationship that, in the opinion of our Board, would interfere with such director’s exercise of independent judgment in carrying out his or her responsibilities as a director, and that each such director qualifies as “independent” as defined by the listing standards of the Nasdaq Stock Market. Ms. Paula Price, who resigned from our Board in February 2019, also qualified as independent during the period of her tenure in fiscal 2019. Mr. Milligan is currently a full-time, executive-level employee of our company and, therefore, is not “independent” as defined by the listing standards of the Nasdaq Stock Market. DIRECTOR NOMINATIONS AND BOARD REFRESHMENT The Governance Committee has adopted a policy regarding critical factors to be considered in selecting director nominees, which include: the nominee’s personal and professional ethics, integrity and values; the nominee’s intellect, judgment, foresight, skills, experience (including understanding of marketing, finance, our technology and other elements relevant to the success of a company such as ours) and achievements, all of which are viewed in the context of the overall composition of our Board; the absence of any conflict of interest (whether due to a business or personal relationship) or legal impediment to, or restriction on, the nominee serving as a director; having a majority of independent directors on our Board; and representation of the long-term interests of our stockholders as a whole and a diversity of backgrounds and expertise, which are most needed and beneficial to our Board and our company. Although our Board of Directors has not established specific diversity guidelines, the Governance Committee is committed to Board diversity and takes into account the personal characteristics, experience and skills of current and prospective directors, including gender, race and ethnicity, to ensure that a broad range of perspectives is represented on our Board to effectively perform its governance role and oversee the execution of our company’s strategy. As further detailed below, the Governance Committee annually evaluates the size and composition of our Board and assesses whether the composition appropriately aligns with our company’s evolving business and strategic needs. The focus is on ensuring that our Board is composed of directors who possess a wide variety of relevant skills, expertise and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of stockholders. Through this process, our Board of Directors, upon the recommendation of the Governance Committee, develops a list of qualifications and skills sought in director candidates. Specific director criteria evolve over time to reflect our company’s strategic and business needs and the changing composition of our Board. 20 WESTERN DIGITAL

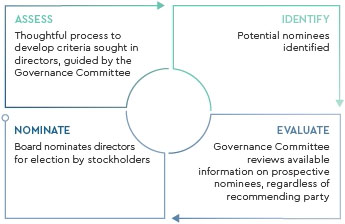

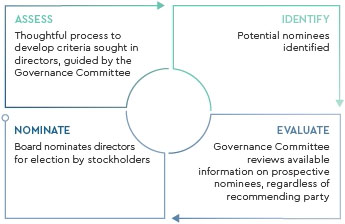

Table of Contents CORPORATE GOVERNANCE MATTERS | | | | DIRECTOR NOMINATION PROCESS |

| | Assess | | Our Board of Directors, led by the Governance Committee, evaluates the size and composition of our Board at least annually, giving consideration to evolving skills, perspective and experience needed on our Board to perform its governance and oversight role as the business transforms and the underlying risks change over time. Among other factors, the Governance Committee considers our company’s strategy and needs, as well as our directors’ skills, expertise, experiences, gender, race, ethnicity, tenure and age. As part of the process, our Board assesses the skills and expertise of our current directors to then develop criteria for potential candidates to be additive and complementary to the overall composition of our Board. Specific director criteria evolve over time to reflect our company’s strategic and transactional metricsbusiness needs and the changing composition of our Board. Please see the section entitled “Corporate Governance Matters—Board Processes and Policies—Board Evaluation” for additional information on our Board’s self-assessment process. | |  | | | | Identify | | The Governance Committee is authorized to use any methods it deems appropriate for identifying candidates for membership on our Board of Directors, including considering recommendations from incumbent directors, management or stockholders and engaging the services of an outside search firm to identify suitable potential director candidates. | |  | | | | Evaluate | | The Governance Committee has established a process for evaluating director candidates that it follows regardless of who recommends a candidate for consideration. Through this process, the Governance Committee considers a candidate’s skills and experience and other available information regarding each candidate. Following the evaluation, the Governance Committee recommends nominees to our Board. | |  | | | | Nominate | | Our Board of Directors considers the Governance Committee’s recommended nominees, analyzes their independence and qualifications and selects nominees to be presented to our stockholders for election to our Board. | |  |

| | | | STOCKHOLDER NOMINATIONS AND RECOMMENDATIONS OF DIRECTOR CANDIDATES |

The Governance Committee may receive recommendations for director candidates from our stockholders. Additionally, our stockholders may nominate director candidates for inclusion in our proxy materials pursuant to the proxy access right set forth in our By-laws or may nominate directors for election at future annual meetings of our stockholders pursuant to the advance notice provisions set forth in our By-laws, in each case as described further below. 2019 PROXY STATEMENT 21

Table of Contents CORPORATE GOVERNANCE MATTERS Stockholder Recommendations of Director Candidates A stockholder may recommend a director candidate to the Governance Committee by delivering a written notice to our Secretary at our principal executive offices and including the following in the notice: the name and address of the stockholder as they appear on our books or other proof of share ownership; the class and number of shares of our common stock beneficially owned by the stockholder as of the date the stockholder gives written notice; a description of all arrangements or understandings between the stockholder and the director candidate and any other person(s) pursuant to which the recommendation or nomination is to be made by the stockholder; the name, age, business address and residence address of the director candidate and a description of the director candidate’s business experience for at least the previous five years; the principal occupation or employment of the director candidate; the class and number of shares of our common stock beneficially owned by the director candidate; the consent of the director candidate to serve as a member of our Board of Directors if appointed or elected; and any other information required to be disclosed with respect to a director nominee in solicitations for proxies for the election of directors pursuant to applicable rules of the SEC. The Governance Committee may require additional information as it deems reasonably required to determine the eligibility of the director candidate to serve as a member of our Board of Directors. Stockholders recommending candidates for consideration by our Board in connection with the next annual meeting of stockholders should submit their written recommendation no later than June 1 of the year of that meeting. The Governance Committee will evaluate director candidates recommended by stockholders for election to our Board in the same manner and using the same criteria as it uses for any other director candidate. If the Governance Committee determines that a stockholder-recommended candidate is suitable for membership on our Board of Directors, it will include the candidate in the pool of candidates to be considered for nomination upon the occurrence of the next vacancy on our Board or in connection with the next annual meeting of stockholders. Proxy Access Our By-laws provide for proxy access, a means for our stockholders to include stockholder-nominated director candidates in our proxy materials for annual meetings of stockholders. A stockholder, or group of not more than 20 stockholders (collectively, an “eligible stockholder”), meeting specified eligibility requirements is generally permitted to nominate the greater of (i) two director nominees or (ii) 20% of the number of directors on our Board. In order to be eligible to use the proxy access process, an eligible stockholder must, among other requirements, have owned 3% or more of our outstanding common stock continuously for at least three years. Use of the proxy access process to submit stockholder nominees is subject to additional eligibility, procedural and disclosure requirements set forth in Section 2.14 of our By-laws.  | An individual or group of stockholders representing3%of outstanding shares for3 years |  |  | Has the ability to nominate the greater of2 nomineesor20%of directors |

Other Director Nominations Stockholders who wish to nominate a person for election as a director in connection with an annual meeting of stockholders (as opposed to making a recommendation to the Governance Committee as described above) and who do not intend for the nomination to be included in our proxy materials pursuant to the proxy access process described above must comply with the advance notice requirement set forth in our By-laws. Pursuant to this advance notice requirement, a stockholder must deliver written notice of the nomination to our Secretary in the manner described in Section 2.11 of our By-laws and within the time periods set forth in this Proxy Statement in the section entitled “Additional Information—General Information About the Annual Meeting—Submission of Stockholder Proposals and Director Nominations.” 22 WESTERN DIGITAL

Table of Contents CORPORATE GOVERNANCE MATTERS Our Board of Directors believes that periodic Board refreshment can provide new experiences and fresh perspectives to our Board and is most effective if it is sufficiently balanced to maintain continuity among Board members that will allow for the sharing of historical perspectives and experiences relevant to our company. Our Board seeks to achieve this balance through its director succession planning process and director retirement policy described below. Our Board also utilizes the annual Board and individual director assessment process discussed below under “Corporate Governance Matters—Board Processes and Policies—Board Evaluation” to help inform its assessment of our Board’s composition and Board refreshment needs. Succession Planning Our Board of Directors is focused on ensuring that it has members with diverse skills, expertise, experience, tenure, age and backgrounds, including gender, race and ethnicity, because a broad range of perspectives is critical to effective corporate governance and overseeing the execution of our company’s strategy. The Governance Committee has developed a long-range succession plan to identify and recruit new directors, and our Board has appointed four new directors in the past five years. The Governance Committee also plans for the orderly succession of the Chairs of our Board’s committees, providing for their identification and development and the transition of responsibilities. Since the beginning of fiscal 2019, the Governance Committee’s succession planning focused primarily on the composition of our Board and its committees, upcoming retirements under our retirement policy, succession plans for committee Chairs, our commitment to Board diversity, including gender, skill sets and backgrounds, and recruiting new directors. As part of our Board evaluation process and taking into account expected director retirements, our Board developed criteria for potential candidates to be additive and complementary to the overall composition of our Board. The Governance Committee engaged an independent search firm to assist with its recruitment efforts and recommend candidates that satisfied our Board’s criteria. Our Board appointed three new directors in fiscal 2019 pursuant to our ongoing succession planning and Board refreshment efforts and in anticipation of the retirements of Mr. DeNero and Mr. Lambert, who will not stand for re-election this year pursuant to our retirement policy (described below). Our Board of Directors and the Governance Committee prioritized directors who could bring complementary skills and experience and who would add diverse perspectives and backgrounds to our Board, which we believe are critical to enabling our Board to effectively represent the long-term interests of our stockholders. APPOINTMENT OF TUNÇ DOLUCA In August 2018, our Board appointed Mr. Doluca as a director. Mr. Doluca brings to our Board over 30 years of executive leadership and technical experience in the semiconductor industry, and he has a strong background in operations, manufacturing and strategy execution. Mr. Doluca was appointed to the Compensation Committee in November 2018, in anticipation of the retirement of Mr. Lambert, who currently serves on the Compensation Committee. APPOINTMENTS OF KIMBERLY ALEXY AND STEPHANIE STREETER In November 2018, our Board appointed Ms. Alexy and Ms. Streeter as directors. Ms. Alexy is the founder of Alexy Capital Management, a private investment fund, and has been an active board member at multiple publicly-traded technology companies for many years. She brings to our Board her deep experience in finance, securities, corporate governance, cybersecurity and the Internet of Things. Ms. Streeter is an accomplished business executive who provides management and operational expertise to our Board. Ms. Streeter served as the chief executive officer of Libbey Inc., a producer of glass tableware and other tabletop products, where she developed and implemented a new corporate strategy and reconstructed the company’s balance sheet, manufacturing network and cost base. Ms. Alexy and Ms. Streeter were both appointed to the Audit Committee in November 2018. In July 2019, Ms. Alexy was appointed as Chair of the Audit Committee to succeed Mr. DeNero. Mr. DeNero remains on the Audit Committee through his retirement to ensure a smooth transition. Ms. Streeter was also appointed to the Governance Committee in February 2019. With these changes, our Board of Directors has sought to refresh its composition while maintaining institutional knowledge with directors of varying lengths of tenure and has implemented forward-looking plans for committee succession. The Governance Committee is committed to continuing to identify and recruit highly qualified director candidates with diverse experiences, perspectives and backgrounds to join our Board. 2019 PROXY STATEMENT 23

Table of Contents CORPORATE GOVERNANCE MATTERS Retirement Policy To help facilitate the periodic refreshment of our Board, our Corporate Governance Guidelines provide that no director shall be nominated for re-election after the director has reached the age of 72, unless our Board of Directors determines in a particular instance that longer tenure is in the best interests of our company and our stockholders. In accordance with our retirement policy, Mr. DeNero and Mr. Lambert are not standing for re-election at the Annual Meeting. In addition, Ms. Cote will reach retirement age under our retirement policy in 2021. THE BOARD’S ROLE AND RESPONSIBILITIES Our Board of Directors and management are committed to regular engagement with our stockholders and soliciting their views and input on important performance, executive compensation, governance, environmental, social, human capital management and other matters. | ● | Board-Driven Engagement.In addition to the Governance Committee’s oversight of the stockholder engagement process and the periodic review and assessment of stockholder input, our directors also engage directly with our stockholders by periodically participating in stockholder outreach, as appropriate. | | ● | Year-Round Engagement and Board Reporting.Our executive management members and directors, together with our investor relations and legal teams, conduct outreach to stockholders throughout the year to obtain their input on key matters and keep our management and Board informed about the issues that our stockholders tell us matter most to them. | | ● | Transparency and Informed Compensation Decisions and Governance Enhancements.The Compensation and Governance Committees routinely review our executive compensation design and governance practices and policies, respectively, with an eye towards continual improvement and enhancements. Stockholder input is regularly shared with our Board, its committees and management, facilitating a dialogue that provides stockholders with transparency into our executive compensation design and governance practices and considerations, and informs our company’s enhancement of those practices. |

2019 Stockholder Engagement As a continuation of our robust outreach program, over the past year, we reached out to stockholders representing approximately 46% of shares outstanding. Our engagement team conducted calls with investors representing approximately 12% of shares outstanding, with the remainder either not responding or confirming that a follow-up discussion was not necessary at this time. While our discussions with investors covered a variety of topics, there were a few key areas of focus in our conversations: | ● | Board composition and refreshment efforts, including the recent additions to our Board; | | ● | Executive compensation philosophy and program design, including how investor feedback drove recent program enhancements; and | | ● | Diversity and culture at Western Digital, including recent developments and enhanced disclosure in our 2018 Sustainability Report. |

These views were shared with our Board and its committees, where applicable, for their consideration. 24 WESTERN DIGITAL

Table of Contents CORPORATE GOVERNANCE MATTERS | | | | CORPORATE RESPONSIBILITY AND SUSTAINABILITY |

We believe responsible and sustainable business practices support our long-term success as a company. Certainly, those practices help keep our communities and our environment vibrant and healthy. But they also lead us to more efficient and resilient business operations. They help us meet our customers’ efficiency targets. They reduce risks of misconduct and legal liability. They enhance the reliability of our supply chain. And they improve the health, well-being, engagement and productivity of our employees. We believe that being an industry leader is not just about having talented employees or innovative products. It is also about doing business the right way, every day. That is why our commitment to sound corporate responsibility is deeply rooted in all aspects of our business. We are happy to share more details about our recent progress in this area through our 2018 Sustainability Report located on our Corporate Sustainability page at www.westerndigital.com (which is not incorporated by reference herein). The Governance Committee oversees our corporate responsibility and sustainability policies and programs pursuant to its charter. Below are some highlights from our 2018 Sustainability Report:  |  |  | | | | Architecting

Sustainable Products | Architecting a Responsible

Supply Chain | Architecting Vibrant Communities | We take responsibility for how our products impact the environment and communities. We believe transparency enhances accountability, helping us improve the long-term sustainability of our products and business.

__________ Efficient packaging conserved 650,000 kg of paper during calendar 2018

__________ Technology innovations reduced power consumption on a per-gigabyte basis by 970 million kilowatt-hour | The need for greater transparency is driving behavioral change in corporate supply chains, as global interconnectedness is greater than ever. We embrace and facilitate this change with our forward-thinking responsible supply chain program, based on a commitment to collaborate with suppliers and key stakeholders to ensure that our value chain is socially responsible and sustainable over the long run.

__________ Achieved one Platinum, two Gold and two Silver certificates after Responsible Business Alliance factory audits

__________ Audited all of our suppliers of conflict minerals, achieving fully compliant sourcing by the end of calendar 2018 | We believe that corporate sustainability should go beyond environmental and labor considerations to provide a positive social impact on the local communities in which we operate. This has led us to an impactful giving and volunteerism program around the world, a deep commitment to inspiring and providing opportunities for future talent through STEM education and scholarship programs, and utilizing our technology and expertise to create positive change on a macro scale.

__________ In calendar 2018, employees from 18 different sites volunteered 5,000 hours for Earth Day

__________ Employees packaged more than two million meals for people without adequate food |

|

|

|  |  |  | | | | | Architecting an Ethical Business | Architecting a Better Environment | Architecting a Stronger Workforce | Working with integrity is a part of our culture—one that we work hard to maintain and enhance. Our efforts help earn the trust of our customers and business partners, inspire our employees, deliver value for our stockholders and improve our communities. __________ Recognized as one of the World’s Most Ethical Companies in February 2019

__________ Conducted global code of conduct training with nearly 30,000 employees in 39 countries over the past year | As we look to the future, Western Digital recognizes that environmental stewardship is critical to the long-term success of our company, our customers and other stakeholders. We are fully committed to responsible use of the Earth’s natural resources and we strive to minimize any impact on climate change as we work together to architect a better future.

__________ Achieved a 3% reduction in overall energy consumption in calendar 2018

__________ Reduced our scope 1 greenhouse gas emissions by 17% between calendar 2016 and 2018 | Our people are our most important asset. Calendar 2018 was a milestone year for our workforce: we focused on creating a unified culture, amplifying the best aspects of our three legacy companies and architecting our path forward as one Western Digital.

__________ Received a perfect score for diversity and inclusion for LGBTQ employees from Human Rights Campaign

__________ Sponsor employee resource groups, including for diverse employees, female employees, LGBTQ employees and veterans |

2019 PROXY STATEMENT 25